bexar county tax office property search

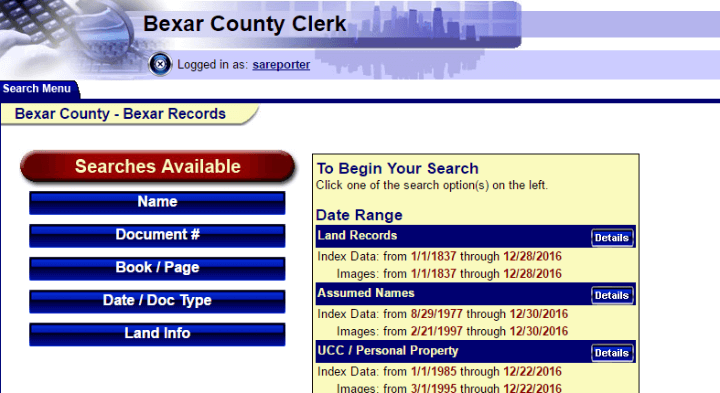

For your convenience the Bexar County Clerks Office is pleased to announce its implementation of electronic recording. Search Any Address 2.

Information Lookup Bexar County Tx Official Website

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

. Search property by name address or property ID. You can search for any account whose property taxes are collected by the Bexar County Tax Office. There are 2 Treasurer Tax Collector Offices in Bexar County Texas serving a population of 1892004 people in an area of 1240 square miles.

Child Support Online Payments. Home of the first ever digital library BiblioTech Bexar County is also the home of such treasures as the. Property Tax Account Search.

Looking up property owners by name and address. They are maintained by various government offices in Bexar County Texas State and at the Federal level. As the 4th largest county in Texas and the 17th largest county nationally Bexar County is steeped in rich history and tradition while at the same time rapidly growing with a population approaching two million.

Prior year data is informational only and does not necessarily replicate the values certified to the tax office. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. Welcome to Bexar County.

Ad Get In-Depth Property Tax Data In Minutes. The Bexar County Treasurer and Tax Collectors Office is part of the Bexar County Finance Department that encompasses all financial functions of the local government. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details.

Search for any account whose property taxes are collected by the Bexar County Tax Office for overpayments. In 2018 the Bexar County Tax Office issued license platesstickers for over 16 million vehicles processed 491927 title. Just Search The Address And See What You Can Find.

Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers. Ad Searching Up-To-Date Property Records By County Just Got Easier. They are a valuable tool for the real estate industry offering both buyers.

Our office is responsible for over 14 million vehicle registrations per year and for collecting over 25 billion in taxes in a fair and equitable manner. You may contact the Bexar County Tax Collector for questions about. Start Your Homeowner Search Today.

100 Dolorosa San Antonio TX 78205 Phone. Your property tax burden is decided by your locally elected officials and all inquiries concerning your local taxes should be directed to those officials Property Search Data last updated on. Change of Address on Motor Vehicle Records.

Click Advanced for more search options. This includes 24 municipalities 12 school districts and 21 special districts. May 30 2022 20720 AM.

Delinquent Tax Data products must be purchased over the phone. Enter one or more search terms. Reports Record Searches.

The Bexar County Treasurer and Tax Collectors Office is part of the Bexar County Finance Department that encompasses all financial functions of the local government. In Texas Bexar County is ranked 253rd of 254 counties. The Bexar County Assessors Office located in San Antonio Texas determines the value of all taxable property in Bexar County TX.

For questions regarding tax amounts visit the County Tax Office Website email or call 210 335-2251. After locating the account you can pay online by credit card or eCheck. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details.

The Bexar County Tax Office collects ad valorem property taxes for Bexar County the Road and Flood Control Fund and 57 other taxing entities. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. Bexar County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Bexar County Texas.

Certain types of Tax Records are available to the general. These records can include Bexar County property tax assessments and assessment challenges appraisals and income taxes. Ad Discover Who Owns Almost Any Property.

Justice of the Peace Online Payments. You can search for any account whose property taxes are collected by the Bexar County Tax Office. TaxNetUSA offers solutions to companies that need Delinquent Property Tax Data in one or more counties including Bexar County TX and want the data in a standard form.

Please follow the instructions below. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. 2022 data current as of May 31 2022 112AM.

For questions regarding tax statements andor property taxes owed visit the County Tax Office Website email or call 210 335-2251. View free online plat map for Bexar County TX. Get property lines land ownership and parcel information including parcel number and acres.

See Property Records Tax Titles Owner Info More. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Property records requests for Bexar County TX.

Tax Bills Who to Contact for Tax Bills. Property Tax Overpayments Search. Electronic Filing of Real Property Documents.

Discover Property Ownership History For Almost Any Address. Bexar County Tax Office. There is 1 Treasurer Tax Collector Office per 946002 people and 1 Treasurer Tax Collector Office per 619 square miles.

2021 and prior year data current as of May 6. 100 Dolorosa San. Receive Bexar County Property Records by Just Entering an Address.

Reports Record Searches. Link to the State Comptrollers site to find out about property taxes as they pertain to the taxpayer. Property records requests for Bexar County TX.

411 North Frio Street San Antonio TX 78207 Mailing Address. You may contact one of the following e-filing providers to electronically file documents with our office. Non-fee License Plates such as Purple Heart and Disabled Veterans.

Resources and searches to help you find the information you need. Search for records and reports of. Looking up property owners by name and address.

County tax assessor-collector offices provide most vehicle title and registration services including. You may contact the Bexar County Tax Collector for questions about.

Contact Us Bexar County Tx Official Website

Bexar County Commissioners Ok 2021 Budget Leaving Property Tax Rate Unchanged

News Flash Bexar County Tx Civicengage

County Commissioners Vote To Decrease Property Tax Rate In 2022

Everything You Need To Know About Bexar County Property Tax

Real Property Land Records Bexar County Tx Official Website

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Bexar County Careers And Employment Indeed Com

Property Tax Information Bexar County Tx Official Website

Funding Shortfalls Hamper Bexar County Courts Tpr

Bexar County Texas Property Search And Interactive Gis Map

Deadline Arrives Monday Night For Protesting Bexar County Property Tax Appraisals Kens5 Com

Commentary County Has Chance To Study Improve Medical Care In Jail

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

High Bexar County Property Values Prompt Residents To Learn The Art Of Protesting Or Find A Consultant

Bexar County Commissioners Approve Funding For Uh Public Health Division Homestead Property Exemption Tpr